Mondassur explains how CFE reimbursements work, depending on the type of treatment, how to join CFE and how to take out complementary expatriate insurance. Find out more about CFE rates in 2025. These rates are to be added to the price of Mondassur complementary CFE insurance. This coverage is essential for all destinations worldwide.

Who can join CFE?

To join CFE, you must :

- haveexpatriate status, i.e. live abroad for more than 3 consecutive months;

- be a French national or citizen of a member state of theEuropean Economic Area (including Switzerland);

- reside abroad or in the French Overseas Territories(TOM).

On the other hand, people working in a neighboring country to France (such as Switzerland) while living in France are not eligible for CFE membership.

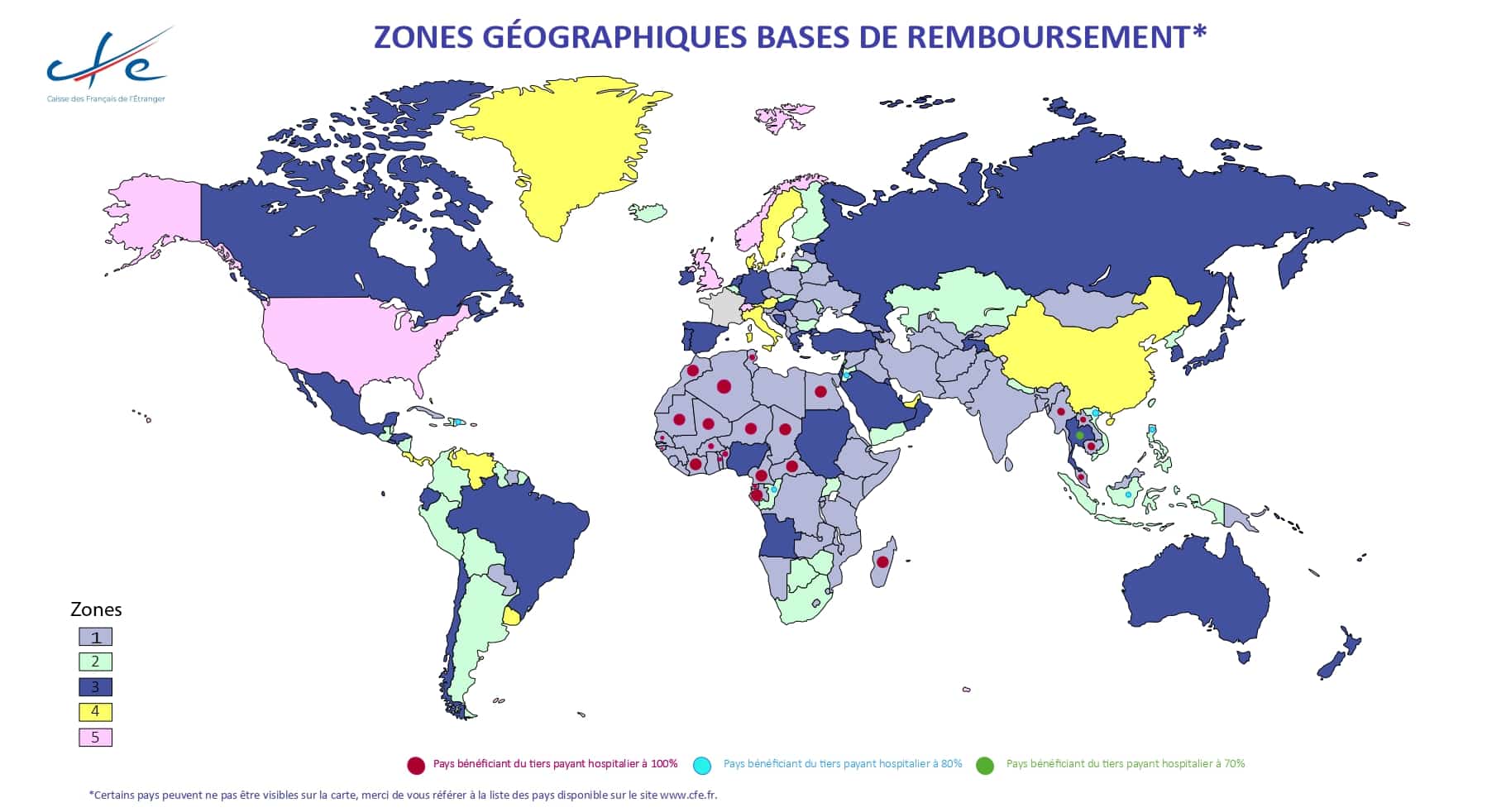

What are CFE’s geographical zones for calculating reimbursement of healthcare costs?

CFE has divided the world into 5 geographical zones, from the least to the most expensive. This classification is based on the medical costs encountered in different countries around the world. In the USA, for example, medical costs are the highest in the world. Some countries, such as Italy, have very high medical costs. Africa and Asia are divided mainly between zone 1 and zone 2 countries. There are a few exceptions in zone 3, due to the obligation to leave the country in order to receive proper treatment.

Here are some examples of countries classified in zones 1 to 5:

Zone 1: India, Madagascar, the Maldives, Tunisia, Morocco and Cambodia.

Zone 2: South Africa, Indonesia, Philippines, Iceland, Jordan.

Zone 3: Brazil, Germany, Australia, Canada, Spain or Mexico.

Zone 4: China, Italy, Costa Rica, Bahamas or Singapore.

Zone 5: Hong Kong, the United States, Switzerland, the United Kingdom and Norway.

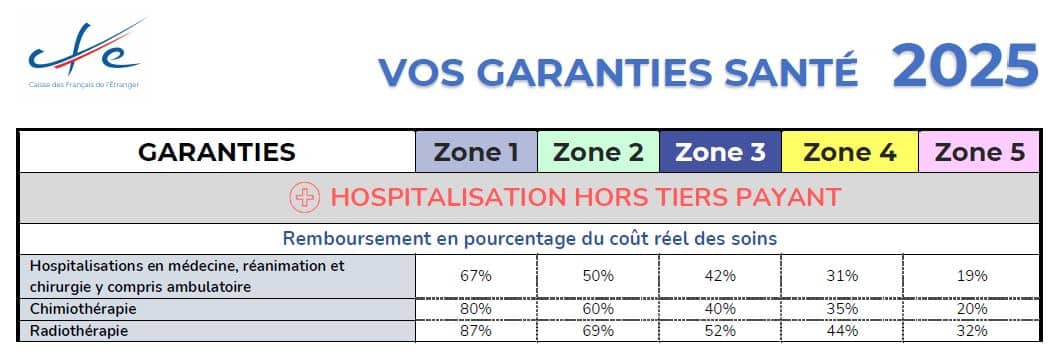

How is CFE reimbursed for hospitalization?

CFE reimbursements for both hospitalization and routine medical care depend on your geographical location, with reimbursements ranging from 19% to 80%. The higher the geographical zone, and therefore the higher the medical costs, the lower the CFE reimbursement percentage. In the USA, for example, the CFE will cover 19% of your hospital costs, or 20% of your actual costs for cancer chemotherapy. In Mexico, your hospitalization will be covered up to 42%. Given these reimbursement percentages, you need to supplement your CFE coverage with complementary CFE insurance such as GoldExpat CFE. Otherwise, you run the risk of having very high out-of-pocket expenses.

How is CFE reimbursed in the event of maternity?

For maternity cover, CFE will take a different view of maternity with Caesarean section than of maternity without surgery. The maximum ceiling for maternity, all zones combined, is around 2,800 euros. Here again, complementary CFE insurance is essential, especially for countries with high medical costs. With the Maternity Plus option, Mondassur also offers enhanced maternity coverage to ensure that your out-of-pocket expenses are not too high.

Here are the maximum maternity ceilings for CFE reimbursement only:

- vaginal delivery: €2985.74

- Cesarean delivery: €3372.17

- Voluntary Interruption of Pregnancy abortion: €954.84

How is CFE reimbursed for medical expenses abroad?

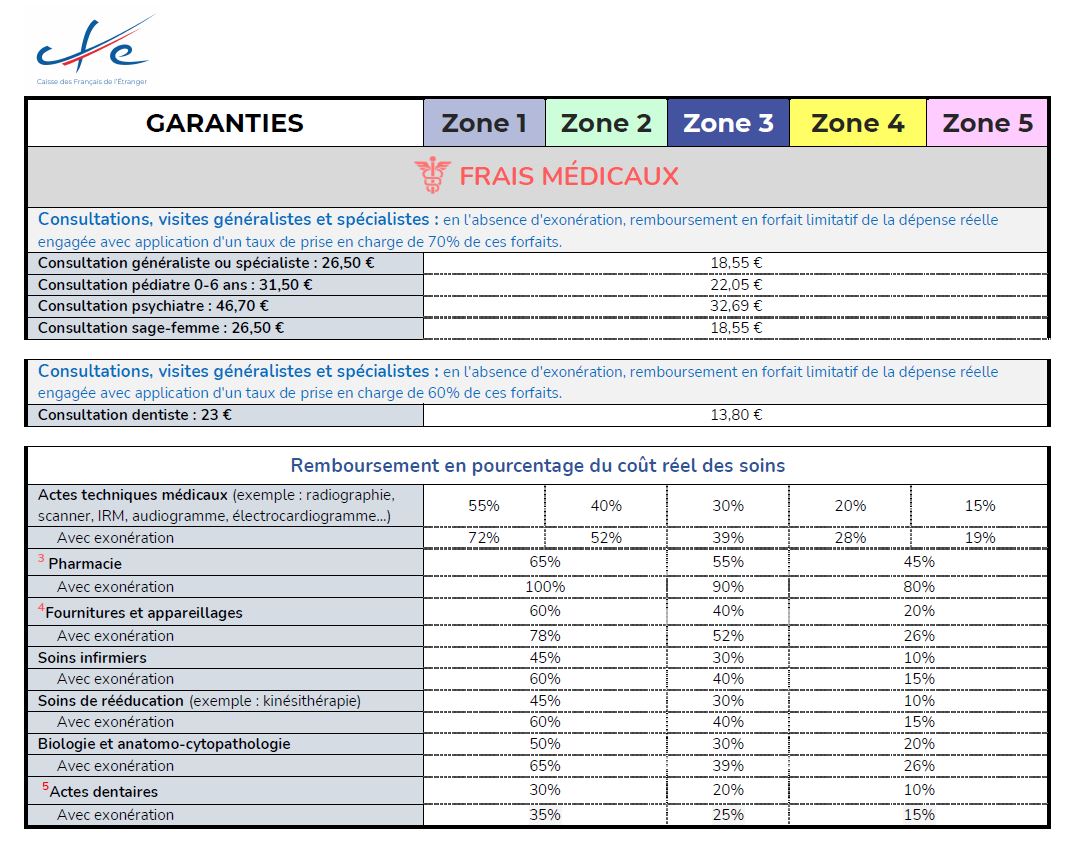

For standard medical care, the CFE always bases its reimbursement on the standard French social security tariffs. This means that, in particular for doctor’s consultations, the CFE will cover a limited amount.

For consultations with a general practitioner or specialist, the CFE will reimburse 70% of the amount spent, capped at the standard tariff, i.e. 26.50 euros for a general practitioner or specialist, i.e. a maximum reimbursement for the insured of 18.55 euros. Your out-of-pocket expenses are likely to remain high, even in countries with low medical costs. Here again, we advise you to take out supplementary CFE insurance.

For other routine medical treatments such as X-rays, MRIs, scans, laboratory tests, pharmacy and dental care, CFE reimbursement will be in % of actual costs, depending on the type of treatment, and will vary between 10% and 60%. For example, for all imaging procedures, which can be very costly, the CFE will cover between 15% and 55%, depending on the geographical area, and dental care between 10% and 30%. The table below gives details of reimbursements for each procedure.

CFE reimbursement levels have been published in the Journal Officiel. They apply universally to all CFE contributors for health cover. Please note that there may be a waiting period of 3 to 6 months, during which CFE will not reimburse you at all, so you can take out a 1st euro insurance policy at first.

How do I join CFE and what are the waiting periods for CFE?

If you join CFE before your departure or within three months of your arrival abroad, coverage begins immediately. Otherwise, your treatment will be reimbursed after 3 months if you are up to 44 years of age, and after 6 months if you are 45 or over.

You can join CFE at any age, without an online health questionnaire. For the Mondassur CFE top-up, membership is taken out at the same time. If the CFE does not cover you, your CFE top-up will not be able to supplement it. When you sign up for the Mondassur CFE top-up, we’ll discuss the options available for your coverage during this period.

Please note that during the CFE waiting period, you will not be covered even for emergency treatment. Initially, you can take out a 1st euro insurance policy.

What reimbursement is available with CFE supplementary insurance?

Supplementary insurance supplements CFE reimbursements. Reimbursements can never be paid in excess of what you have actually spent.

Examples:

- If you have a €250 scanner in Italy, the CFE will cover 20% of this €250. If your complementary CFE mutual insurance company, such as Goldexpat, reimburses you at 90% of your actual expenses, you will be reimbursed a total of €225, split between €50 from the CFE and €175 from your mutual insurance company.

- If you have purchased medication in the USA, you will be reimbursed 45% of the cost of the medication in the USA, and your CFE complementary health insurance will reimburse the remainder up to the maximum amount covered, if applicable.

- If you buy 500 euros worth of medicines, the CFE will reimburse 225 euros and the 90% complementary insurance will reimburse 225 euros, for a total reimbursement of 450 euros.

With Mondassur insurance in addition to CFE, you can request your healthcare reimbursements via your CFE space. CFE will then forward your request to us, so that you receive a single CFE + Mondassur reimbursement. A one-stop shop for your healthcare reimbursements.

How am I reimbursed by CFE for medical care in France?

The CFE covers a portion of your medical expenses incurred in France during your temporary return. Mondassur will supplement these reimbursements according to the cover provided by your CFE complementary contract. You can now use your carte vitale or obtain a carte vitale for your treatment in France: your claims for reimbursement will then be sent by teletransmission to the CFE and to Mondassur if you have taken out complementary insurance with the CFE with us.

How does complementary CFE insurance work with CFE reimbursements?

A complementary health insurance plan to the CFE will offer the big advantage of not having to pay out any money if you need to be hospitalized, as is the case if you only benefit from the CFE.

You will also have the option of sending your claims to the complementary insurance if it operates as a one-stop shop. Otherwise, you’ll have to wait until you receive your CFE statement before you can receive your top-up reimbursement.

Do I need a CFE top-up?

In fact, you’ll need complementary insurance to the CFE. Even if you take out supplementary insurance with low levels of cover, this will enable you to benefit from direct coverage in the event of hospitalization. You can also benefit from worldwide repatriation assistance. So, whether you’re in a country with high or low medical costs, it’s essential to take out complementary insurance with the CFE. The CFE will never cover 100% of your healthcare costs, and may cover less than 20% depending on the country you live in.

Get a free quote to find out the cost of complementary CFE insurance, and compare it with 1st euro expatriate insurance. In other words, it reimburses you without any CFE involvement.